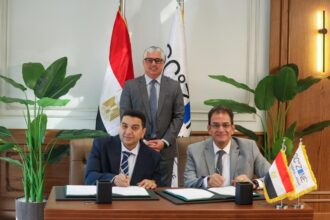

Chairman of Banque Misr Mohamed El-Etreby, signed a loan agreement worth € 500m on Sunday with the European Investment Bank’s (EIB) Director Flavia Palanza.

The signing of this agreement comes within the framework of BM’s support and diversification of various sources of financing, to use it in financing small and medium enterprises (SMEs).

The loan has a term of three years and contributes to the enhancement of the bank’s foreign currency resources, which are used to finance SMEs.

This is the second agreement signed by Banque Misr with the EIB, where the first agreement was signed with € 500m, and have been disbursed in two tranches, bringing the total contract to €1bn.

According to the bank’s statement, it is keen on strengthening and diversifying its foreign currency resources, which are used to finance projects of various sizes, based on its leading role in supporting the Egyptian economy and SMEs, believing that these projects are the engine of economic growth towards sustainable development.

BM Bank is one of the first banks to comply with the requirements of the Central Bank of Egypt (CBE), taking SMEs financing portfolio to 20% of the bank’s total credit portfolio before the end of the period specified by the CBE on January 1, 2020. This achieved a great development in SMEs’ growth rate in the Finance and Microfinance Sector.

This comes from the state’s orientation, in line with the CBE’s requirements that urged banks to increase the size of their project finance portfolio to about 20% of the total size of the financing portfolio, due to the critical impact projects have on the national economy. It’s also vital for including youth, women, and other marginalised segments of society, which is reflected in reducing unemployment and increasing per capita income growth. Accordingly, this would affect national GDP rates by increasing production and covering local market requirements.

Banque Misr finances small, medium, and micro projects through its branches in all governorates, in various industrial, agricultural, and service fields.

The portfolio of SMEs reached EGP 26bn at the end of September 2019, with an average growth rate of 120% over four years since the CBE was launched.

Banque Misr won the Bank of the Year Award for SME Finance in Africa in 2019 from ”Corporate Live Wire” magazine in the field of SME Finance and Microfinance.

Banque Misr’s award is a certificate of merit for the trust of its customers, which is always what the bank focuses on, as they are partners in success in all business.

The bank always strives to provide all the new services and products to meet the needs of customers.