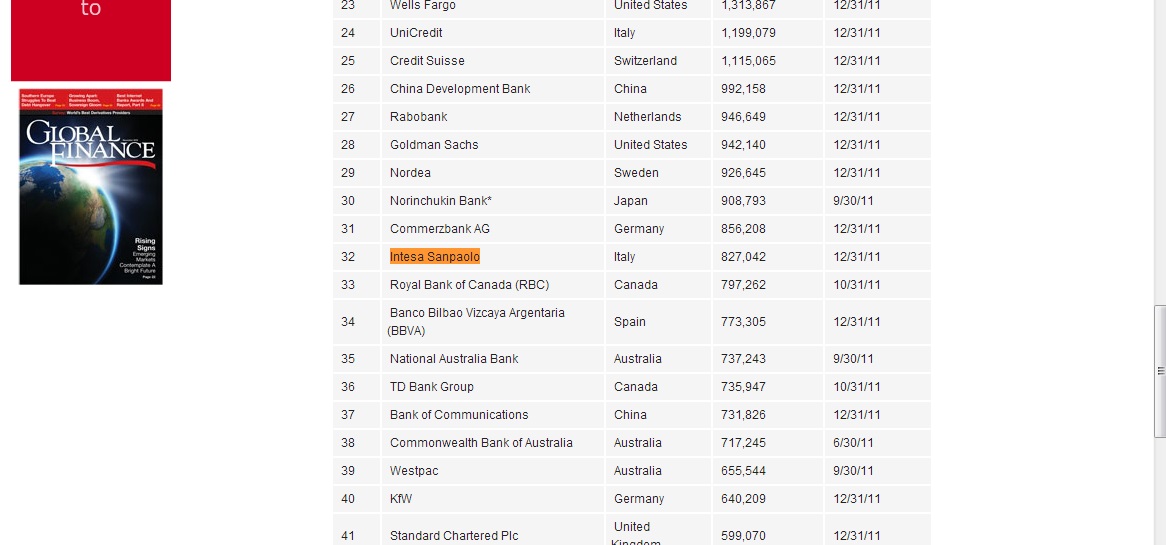

(Photo screen grab from US-based magazine Global Finance )

Intesa Sanpaolo, owner of Egyptian bank Bank of Alexandria, was recently named Best Italian Bank of 2013 US-based magazine Global Finance.

Global Finance based its decision on a number of claims made by economic analysts and leading personalities in the international banking arena, assessing the bank based on its yearly growth figures in assets, as well as its quality of assets, profitability, geographic reach, strategic relationships developed, business development, and innovation in products.

These assessments came from a number of officials working with credit rating agencies and international banking institutions.

Joseph D Giarbuto stated in the article that “all institutions that won the award for best bank in their respective countries did so by best meeting the needs of their clients”.

He added: “The nature of financial markets changes from region to region, however we can acknowledge that, overall, banks worldwide are experiencing challenges today. Despite these challenges, those banks who earned awards accomplished great achievements.”

Commenting on the award, Executive Director of Intesa Sanpaolo Enrico Kukiyani stated: “We are proud to have won this award which recognises our role as a primary player on the international market. Despite the difficult circumstances facing the market today, our policy of focusing on the public budget and promoting liquidity has ensured our sustainable long-term profitability.”

“Despite the world-wide recession,” he added, “our company indicators and performance have been far better than our European competitors, in addition to the fact that we are one of the few banks in world whose policies are compatible with the Basel III accords.”

The bank operates with a number of subsidiaries active in over 40 countries, with an additional 1,500 of its own branches located in 12 countries throughout Eastern Europe, Central Europe, the Middle East and North Africa, boasting a total of 8.3 million clients. The bank provides retail banking services both to companies and individual clients.

The bank also provides its customers access to banking activities outside their home countries in over 29 different nations, managed and operated by its International Division of Corporate Services and Investment Banking.