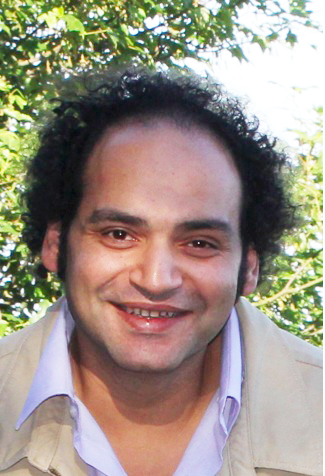

By Luigi Zingales

CHICAGO: When Dominique Strauss-Kahn, a former French finance minister, was appointed Managing Director of the International Monetary Fund in 2007, many developing countries objected — not to him, but to the tradition that gave the IMF’s top job to a European, with the Americans installing one of their own at the World Bank.

This antiquated international spoils system is a leftover of the post-World War II order, in which the victorious powers divided the leading positions in the world economic institutions among themselves. That arrangement made some sense when the United States represented 35 percent of the world economy and Western Europe another 26 percent, but today, the balance of economic power has shifted. The US accounts for only 20 percent of the world economy, and Western Europe for 19 percent.

But there was an even more compelling reason — though not obvious at the time — why the IMF director appointed in 2007 should not have come from Europe: the need to avoid conflicts of interest.

When the IMF’s lending was mostly concentrated in Asia and Latin America, it was only logical that the director should come from a country outside of those regions. After all, how credibly could a Japanese managing director impose tough conditions on South Korea, or a Chilean director on neighboring Argentina? At a time when developing countries did most of the borrowing and developed countries did most of the lending, the primacy of the US and Europe was justified.

But nowadays developing countries represent a much larger share of global output — and an even bigger share of world lending. So, just as no one would not want a bank to be controlled by its biggest borrowers, everyone should be concerned about a European with potential political ambitions being in charge of IMF policy given Europe’s current financial difficulties.

Indeed, the severe sovereign-debt crisis that many European countries are now facing means that the only thing worse than a European leading the IMF is a European leading the IMF who, like Strauss-Kahn, also may run for his country’s presidency.

Europe’s sovereign-debt crisis is forcing tough choices, and the IMF’s director must work on several contingency plans. What should the IMF do if a country wants to leave the eurozone, or if a European country defaults on its debts, as Argentina did?

Although, such scenarios may seem unlikely, it is the responsibility of the IMF to peer ahead and prepare for the worst contingencies. It is incumbent that such preparations, and the decisions that would follow, not be seen as having been influenced in any way by personal political considerations and ambitions.

The potential for a conflict of interest would worsen if Europe were to face another crisis. How could the citizens of a country being rescued by the IMF accept conditions that might have been influenced by a desire to improve the electoral chances of a potential candidate for high office, rather than a desire to improve the country’s long-term sustainability? And how would ordinary European citizens judge the fairness of the costs, when the man in charge of determining and allocating these costs may decide to seek the French presidency?

Many countries attempt to prevent vested interests from “capturing” the state by barring government appointees from moving to private-sector jobs for a certain period of time. Why shouldn’t a similar rule apply to appointees to international organizations vis-à-vis political positions in their own countries?

A famous French economist told me that he hoped no new crisis would hit Europe until June, because a crisis any sooner would jeopardize Strauss-Kahn’s ability to leave the IMF at the right time to run in the French Socialist Party’s primary for the 2012 presidential election. Such comments may be understandable coming from a Frenchman concerned about his country’s welfare, but they should be unacceptable to everyone else. During the next crisis, no one should want the IMF’s director to be distracted, or to be weighing interests that are not pertinent to protecting global financial stability.

In the interest of the IMF’s credibility — and of the stability of the world economy — Strauss-Kahn should put the matter to rest once and for all, by declaring unequivocally his intentions regarding the French presidency. Whichever path he chooses, he cannot continue to straddle the issue. If he chooses to run, he must leave the IMF.

Luigi Zingales is Professor of Entrepreneurship and Finance at University of Chicago Graduate School of Business and co-author, with Raghuram G. Rajan, of Saving Capitalism from the Capitalists. This commentary is published by DAILY NEWS EGYPT in collaboration with Project Syndicate (www.project-syndicate.org).